The UAE appears to be sidestepping the fiercest aspects of the struggle for finance talent prevailing in many parts of the world. And despite concerns about a slowing global economy, business activity in the country remains robust. With the economy on track to expand, organisations are likely to have room for expansion.

‘The UAE market is quite different to the European market and, compared to global markets, inflation and energy prices are relatively low. Meanwhile, thanks to Vision 2030, the Saudi economy is booming and that’s having a positive impact on the UAE,’ says Amy Bassindale, accountancy and finance business manager, Gulf region at Hays.

In addition to Saudi Vision 2030, UAE Expo 2020 and the Qatar World Cup also brought an influx of new candidates for employers to choose from, so while opportunities are available, candidates with the right combination of skills and experience need to project these.

'The most in-demand candidates find themselves with multiple offers in hand’

Differentiate yourself

‘To stand out from the crowd, it’s imperative that candidates highlight a competitive edge and track record,’ says Bindita Baksi, managing consultant (accounting and finance) at Michael Page Middle East.

This is not to say opportunities are few and far between. The market for finance and accounting professionals is enjoying a positive post-pandemic recovery, with businesses in need of people with accomplished technical, technological and soft skills.

‘While there’s no change in terms of the talent available as we operate in a candidate-heavy market, the most in-demand candidates – qualified professionals with strong technical and commercial experience, and stable employment backgrounds – find themselves in a position where they have multiple offers in hand,’ says Bassindale.

And while most hiring activity in the first quarter has been in junior to mid-level positions, notes Anchal Kalra, manager at Robert Walters Dubai, ‘we predict a resurgence in hiring of business-critical senior leadership in the latter part of the quarter, as seen in the past few years’.

Businesses are hiring experienced tax professionals as they gear up for corporate taxation

Sought-after roles

With significant changes taking place in the Middle East’s tax landscape, there is high demand for experienced tax professionals, especially direct tax professionals to support businesses as they gear up for the introduction of corporate taxation, which is due to come into effect in UAE for financial years beginning in June 2023 onwards (read our AB article, Get ready for UAE corporate levy).

‘Large local diversified conglomerates are hiring tax professionals more aggressively than global multinationals (MNCs),' notes Baksi. 'One reason behind this could be that as taxation is still at a relatively nascent stage in this region, global MNCs are using a centralised tax function outside of the Middle East to optimise cost.’

The tax changes are also seeing greater hiring of tax professionals at Big Four firms as some businesses engage their services to prepare for the new policies, and this is having a knock-on effect among business consultancies more broadly, as well as government agencies.

'Companies are seeking senior finance professionals with a track record of business transformation'

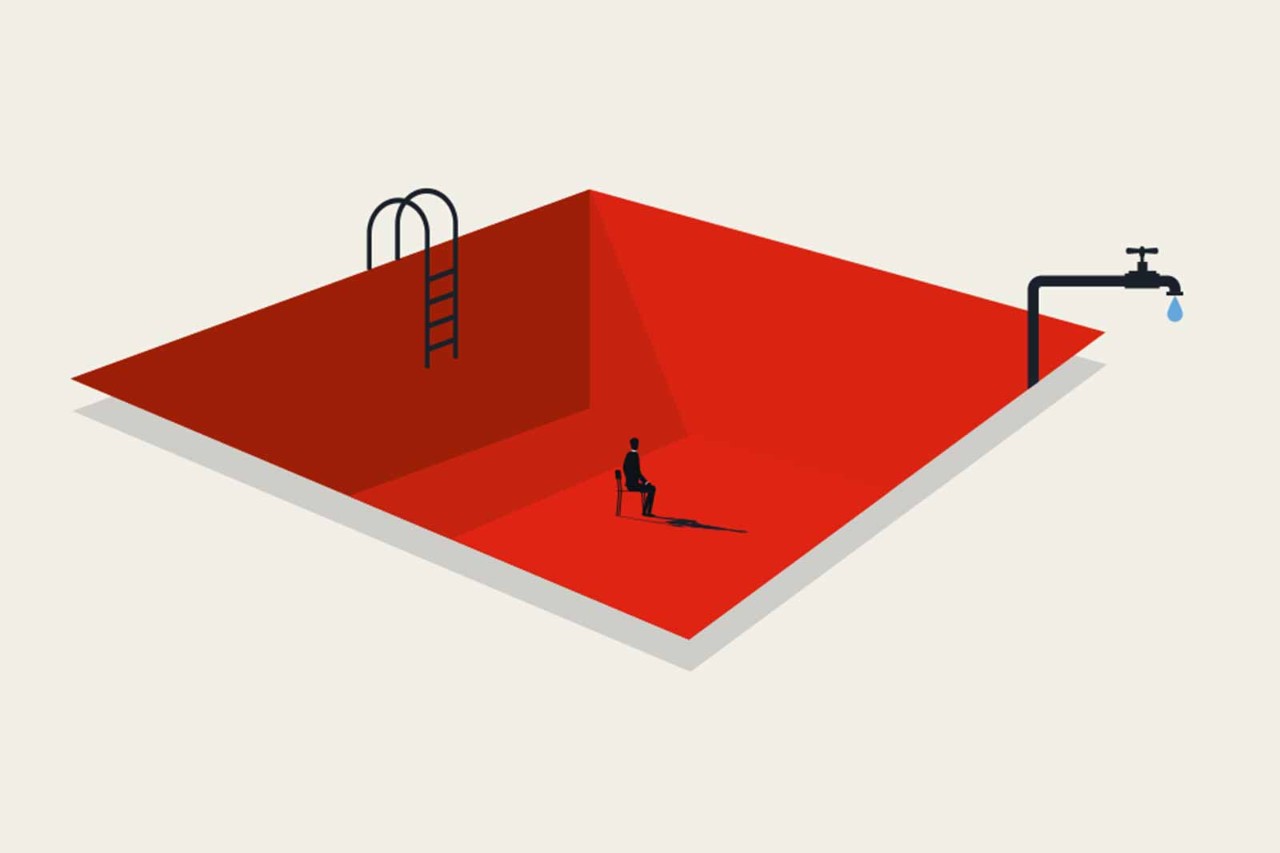

The universal trend for finance digitisation and automation is another key disruptor, notes Baksi. ‘In the past couple of years, a lot of businesses have automated or outsourced their accounting/transactional activities, resulting in less demand for core accounting positions, particularly at a senior/executive level.

‘In fact, from manager level upwards, there is now more demand for business finance/strategic finance professionals who have a specific track record of business transformation – for example, in restructuring, risk management and digital transformation.’

This is also creating greater demand for FP&A, commercial finance and business partnering professionals to help organisations effectively implement new strategies, transformations and systems, as well as those with data analytics and visualisation skills to support optimisation and decision making.

Required skills

Lastly, at the more junior levels there continues to be a high volume of jobs/movement across accounting, tax, internal audit, financial planning and analysis, Baksi notes. ‘However, employers are extremely specific with their requirements, even for junior roles – for example, they may look for related industry experience, specific systems skills, language skills, etc.’

‘Professional qualifications will always benefit candidates in the UAE market,’ says Bassindale. ‘In terms of in-demand skills, clients want candidates who can demonstrate strong technical accounting skills and knowledge (IFRS, etc), in addition to strong business partnering and commercial finance knowledge with a strategic focus. A solid, progressive work history will also benefit candidates.’

Salary trends

Despite the influx of candidates into the market, employers would be foolish to think the balance has tipped entirely their way, if Robert Half’s 2023 salary guide findings are anything to go by (see graphics). These show that as many as 46% of employees in the UAE are planning a job change in 2023, so businesses will need to work harder to keep and attract expat talent.

Hays expects salaries to remain largely stable in 2023, and Robert Walters foresees a moderate 3-5% growth. In this scenario, candidates, especially for in-demand roles, will be pressing for other benefits, including some level of flexible working – at present, over 50% of accounting and finance roles in the UAE are fully office based.

More information

See highlights from ACCA's report, Global Talent Trends 2023

Find more careers guidance and ACCA’s jobs board on our Careers hub