Ask anyone in the United Arab Emirates and they will tell you that business is booming. With the country hosting COP28, the World Bank says GDP grew by 7.4% last year and the country ranks 15th as a global investment destination. Its economy is also managing massive structural reform with 70% of output now coming from non-oil sectors, according to the Ministry of Finance.

It’s no surprise then that observers and consultants report significant growth of single-family offices – private companies set up to manage the wealth of a single family. Nine out of 10 private businesses in the UAE are family enterprises and they are estimated to contribute about 70% of the country’s GDP. KPMG estimates that by 2026 ultra-high-net-worth individuals (UHNWI) will contribute around 46% of the UAE’s financial wealth, which is calculated to reach US$1trn in the same year.

The UAE has a reputation for being ultra-safe

Single-family office numbers (hard to count because there are no published statistics) have grown in two ways: local families restructuring their wealth, and the arrival of high-net-worth individuals (HNWI) from elsewhere in the world.

Dedicated advice

In both cases they see a country that has restructured the regulatory landscape and husbanded a dedicated advisory ‘ecosystem’. Health and education systems have been improved, the UAE has a reputation for being ultra-safe, and it provides a central point for travel to any other regional or global location. As such, it has become one of the most welcoming locations in the world for wealth management.

‘The UAE’s strategic location offers unparalleled access to key global markets,’ says Adam Ladjadj, founder of the Emirates Family Office Association. ‘Political stability and security are paramount, creating a safe environment for investments.’

As well as changes to the investment environment, the government has acted to regulate the governance of family wealth.

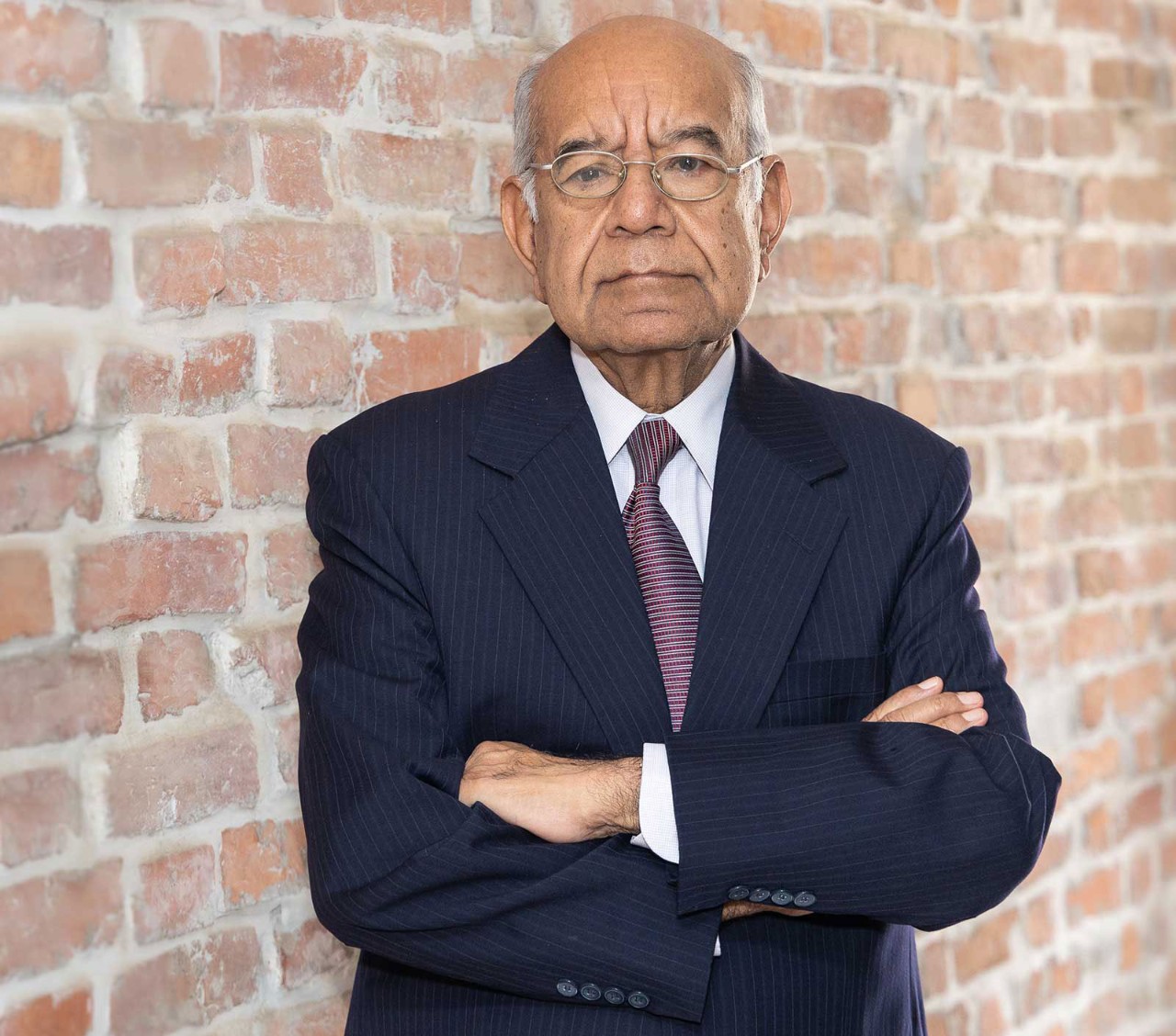

Raajeev Batra, head of private enterprise, KPMG Lower Gulf, says: ‘The UAE realised that if it was to compete with the likes of the UK and Singapore, it would need to make sure that, besides creating high-quality infrastructure, it had a governance framework too.’

Consultants say wealth is being moved to the UAE from a host of other jurisdictions, including India, the UK, Russia, Lebanon, South Africa, Hong Kong and China.

Fuelling growth

The changes to the legal landscape are fuelling growth in the sector. Last year UAE Federal Decree Law 37 was passed to create a legal framework for ownership and governance of family wealth, as well as smooth the way for the transfer of wealth from one generation to another. The law creates a family business register and is partly aimed at families relocating to the UAE.

The trend continued this year with Federal Decree Law 31, the so-called New Law, providing further support for the creation of local trusts, while also recognising foreign trusts.

Local families have been taking advantage of this new landscape

And that’s not all. While the legal environment has been under reform, there has also been an effort to mould a professional infrastructure for family offices too.

This year saw the launch of the Dubai Family Wealth Centre, which provides education and training as well as access to expert advice in law, finance and philanthropy, and a registry of advisors. The Emirates Family Business Association also launched this year, hoping to provide a platform for knowledge sharing and networking.

Events have also helped to create a culture of wealth management. Last month, for example, Abu Dhabi hosted the International Family Office Congress, a conference that saw the attendance of more than 300 family office principals.

Family ecosystem

‘They are creating an ecosystem for families,’ says Nina Authoybur, managing director, UAE, at Ocorian, a provider of fiduciary services. ‘That gives not only asset protection, but also comfort that the regulator, as well as the government, is encouraging family businesses… to properly restructure as single-family offices with a proper succession plan.’

Local families have been taking advantage of this new landscape. Many have seen their families and wealth grow hugely since the UAE’s founding in 1971. And many family heads are reaching a stage when they want to hand over the reins.

Recent events have perhaps played a role in their decision-making. Batra says: ‘Post-Covid, everyone has realised that mortality is a reality. They realise they won’t live forever and, therefore, they need to make sure there are mechanisms to protect their wealth.’

Wealth is being moved out of corporate structures into dedicated family offices

At the heart of the new thinking is the ‘professionalisation’ of wealth management. Previously, family wealth tended to be left inside companies and managed by a small team, often led by the company CEO or CFO.

Wealth is now being moved out of corporate structures into dedicated family offices run by investment professionals with larger teams. The emphasis means families are moving on from ‘lifestyle’ management of their wealth. ‘The new generation has different ideas,’ says Batra.

Wealth preservation

According to Ladjadj, the shift means family offices are being used to ‘ensure wealth preservation and efficient international growth’, as well as ‘maintain family wealth across generations’.

‘The work in family offices presents a challenging and rewarding career path’

Professionalisation means compliance with new regulations and the use of strong governance, he says. But it also creates a demand for skilled professionals ranging from investment and legal experts to accountants.

‘The multidisciplinary and sophisticated nature of work in family offices presents a challenging and rewarding career path, making it an increasingly attractive field for accountants,’ says Ladjadj.

Tayyab Mohamed, co-founder of Agreus, a search firm working with family offices around the world, agrees that the family-office boom will place a premium on accountancy knowledge. ‘It is going to create a demand for accountants and qualified people, especially those with an institutional mindset,’ he says, adding: ‘For people who have professional qualifications like ACCA, there are many opportunities.’