In a perfect world, we would always come to our senses before the worst happened. However, reality dictates that we sometimes have to endure hard lessons. And there have been few teachers tougher and harsher than the Covid-19 pandemic.

The sole consolation is that we are not likely to soon forget whatever we have learnt from the global health crisis. Arina Kok, EY director for climate change and sustainability services, says: ‘The widespread health and economic impact of the pandemic has been a rude awakening for businesses, who now realise that prioritising shareholders over stakeholders does not augur well for longer-term sustainability.’

Employee welfare, for example, came to the fore last year. Businesses paid dearly for crowded housing, half-hearted Covid-19 preventive procedures, and general lack of care for the wellbeing of workers.

‘It is clear to more people now that there is a direct nexus between stakeholder interests and profits’

Devanesan Evanson, CEO of the Minority Shareholders Watchdog Group, points out that company profits are jeopardised when workers are quarantined, and factories and stores closed to curb the spread of infection. ‘Particularly vulnerable are companies that have institutional investors and those that export a lot of their products. It is clear to more people now that there is a direct nexus between stakeholder interests and profits,’ he adds.

The coronavirus-triggered blooming of social consciousness has happened all over the world, but what ASEAN has in its favour are roadmaps and trail-markers that can point businesses in the right direction.

Building resilience

The ASEAN Economic Community (AEC) aims to be a more resilient, inclusive and people-centred community by 2025. Its Blueprint 2025 covers sustainable economic development, a stronger role for small businesses, deeper private sector involvement in ASEAN integration, public-private partnerships, narrower development gaps and a greater contribution from stakeholders such as civil society organisations. Meanwhile the ASEAN Comprehensive Recovery Framework proposes rethinking supply chain resilience, accelerating digital technology adoption, and developing human capital through upskilling and reskilling.

There is certainly a pathway to business enlightenment in the region, but is there a will to stay the course? Is the pandemic a sufficient shock to the system to convince businesspeople once and for all that they can do well by doing good?

To embrace stakeholder capitalism, says Kok, businesses need to clearly define their purpose and role in society, and determine how they can create value and broad-based prosperity for their people and society while generating profits.

Value creation for stakeholders is like a banquet where customers, suppliers and communities can eat only after a controlling shareholder has had their fill

Shareholder supremacy

There are plenty of conversations in the US and Europe about purpose and the shift from shareholder primacy to stakeholder capitalism. In many parts of Asia, however, the business world needs first to break away from shareholder supremacy.

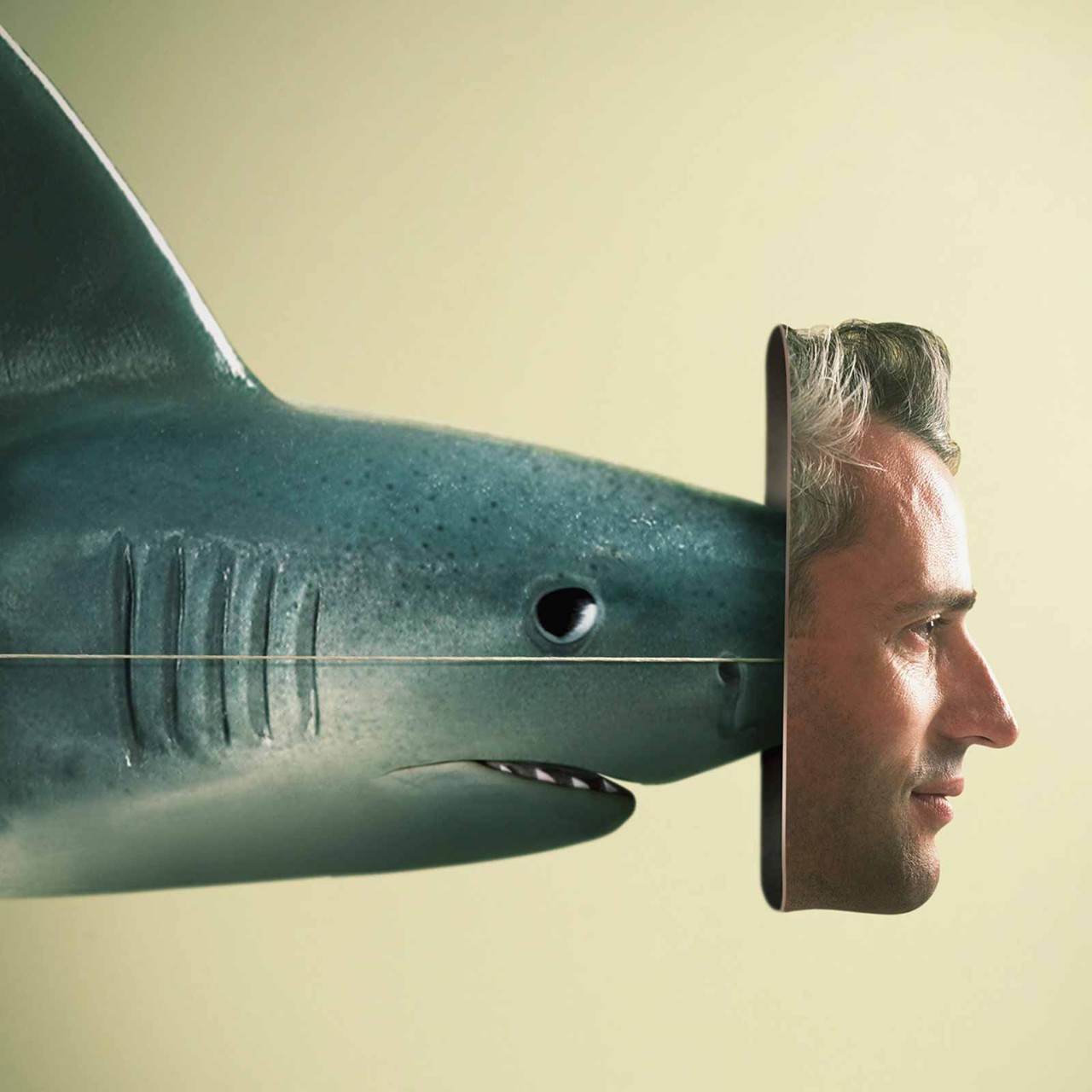

Concentrated ownership structures are typical in corporate ASEAN. The largest equity stakes in many companies are in the hands of governments, individuals or families accustomed to having the final say in board decisions and the running of the businesses. Some believe that a heavy focus on maximising shareholder value will ultimately benefit the stakeholders. The problem with this approach is that value creation for stakeholders is incidental and secondary – it’s like a banquet where customers, suppliers, workers and communities can eat only after a controlling shareholder has had their fill.

Stakeholder power

It is unrealistic to expect ASEAN business leaders to drive the pivot from profit to purpose entirely on their own. Stakeholders themselves must supply some impetus. Fortunately, there are encouraging signs that this will happen.

Ideally, says Devanesan, board members should hold themselves accountable for greater stakeholder interests. If they do not, the government, institutional investors, other companies in ASEAN and NGOs can all play a role in driving stakeholder capitalism.

Stakeholders particularly stand to gain when companies vie for foreign funds. According to Devanesan, ASEAN corporations compete for funds from foreign institutional investors, and those investors set great store by stakeholder rights. ‘When it comes to stakeholder interests, ASEAN companies are in a race to the top to be the preferred investment choice,’ he says.

Accountants too ought to be a part of the move to go beyond the financials. Even in stakeholder capitalism, organisations need to work out targets, measure outcomes, crunch numbers and produce reports that others rely on

Further information

Watch this video ‘What do investors want from climate disclosure and how do they use the information?’ by A4S (Accounting for Sustainability)

Business leaders who insist that climate change is somebody else’s problem may find themselves pushed into irrelevance. Kok says the growing focus on climate risks among investors, regulators and stakeholders has further increased pressure on businesses to demonstrate responsible practices within their value chain.

‘Younger customers are more sensitive to corporate behaviour,’ says Nik Mohd Hasyudeen, group MD and CEO of government-linked investment company Tabung Haji, and the former president of the Malaysian Institute of Accountants. ‘They will exert more pressure on environment, social and governance [ESG] issues. This is a growing trend in ASEAN. Businesses that fail to connect with their customers and investors may be left behind.’ His remarks are backed up by ASEAN demographics – 15 to 34-year-olds make up about a third of the population of the bloc.

Accountants’ vital role

This may sound odd, but accountants too ought to be a part of the move to go beyond the financials. Even in stakeholder capitalism, organisations need to work out targets, measure outcomes, crunch numbers and produce reports that others rely on.

The International Business Council of the World Economic Forum teamed up with the Big Four accounting firms to identify ESG metrics and disclosures that could be reflected in companies’ annual reports of companies. Its report came out last year.

But it is not all about numbers. Devanesan says accountants’ financial expertise positions them to persuade and influence senior management and directors on the connection between stakeholder interests and the enhancement of long-term shareholder value. He adds: ‘Accountants in general, regardless of their occupation, are bound by codes of ethics. And surely it is ethical to consider the interests of employees, suppliers, customers and the community whenever making a recommendation or a decision.’

Nik Hasyudeen points out that many accountancy bodies are promoting ESG and sustainability issues to the business community. ‘As ASEAN becomes a more integrated market, collaboration between the region’s accountancy bodies will hasten the adoption of such matters in corporate strategies, business operations and performance measurement,’ he says.

He adds that accountants in ASEAN can also influence public policy by sharing information and ideas with governments on the subject of balancing economic needs and the well-being of society.