FRS 101

The Financial Reporting Council (FRC) is proposing to amend FRS 101, Reduced Disclosure Framework, to account for changes to IAS 1, Presentation of Financial Statements, and allow for some disclosure reduction for property, plant and equipment.

FRS 101 is technically Companies Act financial statements but prepared under IFRS Standards with reduced disclosures. It is used only for subsidiaries of companies reporting under IFRS Standards.

You can read the FRC’s exposure draft on the proposed changes here.

FRS 104

FRS 104, which is used when preparing interim financial statements, such as quarterly or half-yearly financial statements, has been amended. The amendment clarifies and enhances the requirements relating to the going concern basis of accounting for interim financial reports. It comes into effect for interim periods beginning on or after 1 January 2021, with early application permitted.

Lease accounting

The International Accounting Standards Board (IASB) is consulting on changes to lease liability in a sale and leaseback. The proposed standard aims to clarify how a seller-lessee should apply the subsequent measurement requirements in IFRS 16, Leases, to the lease liability that arises in a sale and leaseback transaction.

Group reconstructions

IASB has opened a public consultation on the accounting for group reconstructions. Currently under IFRS Standards there is very little guidance other than an allowance to conduct these transactions at ‘cost’, but some entities undertake group reconstructions at fair value. The International Auditing and Assurance Standards Board (IAASB) also notes that the level of disclosures made by companies are inconsistent.

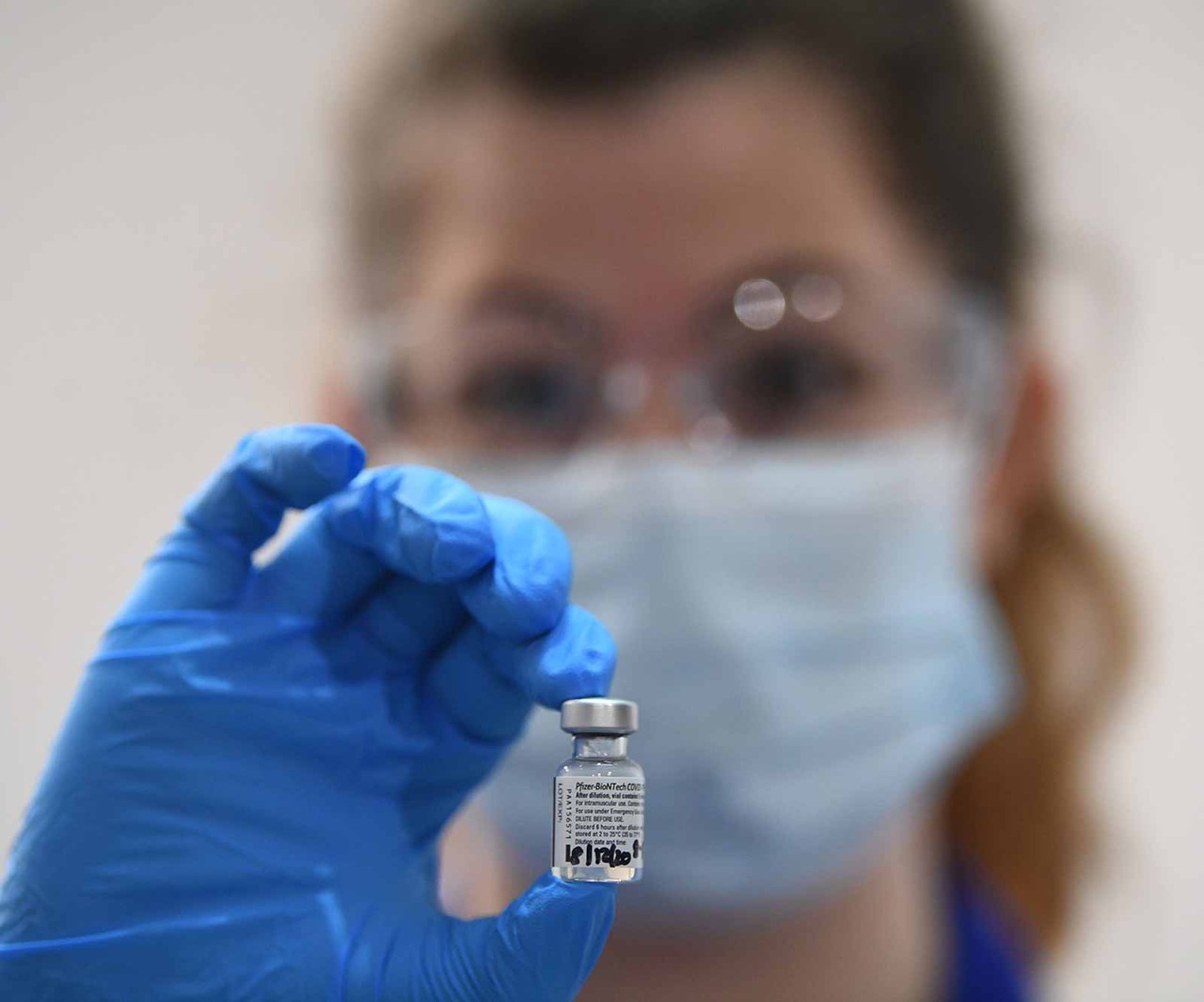

Covid-19 guidance

Enormous amounts of technical guidance have been issued for Covid-19, to the extent that it is sometimes difficult to identify what is superseded and where the most up-to-date guidance is located. In the UK the FRC has consolidated its Covid-19 guidance for auditors and its guidance for companies.

For auditors struggling to meet the requirements of IES 8, Professional Competence, the non-verifiable CPD available from reading the FRC auditing guidance will fulfil the requirements for some of the 15 different prescribed audit CPD areas in that standard.

Ethical standards

The Irish Auditing and Accounting Supervisory Authority (IAASA) has revised the ethical standards for auditors. The changes mirror those made in the UK by the FRC, which in turn reflect changes made to the IAASB standard. You can read ACCA’s response to the changes here.

The new standard replaces guidance with compulsory requirements for matters such as the provision of non-audit services and applies those requirements to all audits, including very small audits. The revised standard is effective for audits of financial statements for periods beginning on or after 15 July 2021, with early adoption permitted. Auditors will need to update their standard work programmes and checklists.

Audit quality standard

IAASA has issued an amendment to the ISQC 1 standard. The revised quality control standard is effective for audits of financial statements for periods beginning on or after 15 July 2021, with early adoption permitted. Auditors will need to update their ISQC 1 manual before that date.

Cashflow errors

The FRC has published a review of UK companies’ compliance with IAS 7, Statement of Cash Flows, and the liquidity disclosure requirements of IFRS 7, Financial Instruments: Disclosures.

The FRC notes that it continues to see errors in cashflow statements and that ‘most companies could improve their disclosures of accounting policies and judgements in relation to the cashflow statement’. For liquidity disclosures, the FRC includes some recent examples of good reporting that companies should find helpful. You can find the review here.